In the video above, Paul Grant Truesdell, J.D., AIF, CLU, ChFC, RFC describes the Truesdell Wealth, segregated income approach called: DIAL TAME - Delayed Income Advantage Leverage

Work through your numbers, and then watch the video below.

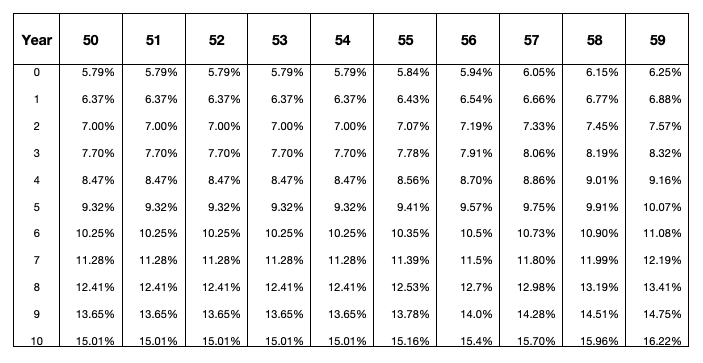

50s

60s

70s

Your Calculations

Select your age.

Select the year you want to begin drawing a lifetime income.

Find the percentage.

Use the percentage and the dollar amount you want to invest to determine your income.

For example, $100,000 at age 75 will generate a 20.58% annual income stream (100,000 times .2058 equals $20,580).

For example, $25,000 at age 71 will generate a 19.49% annual income stream ($25,000 times .1948 equals $4,870)

Now, use the Annual Income Calculator and enter a dollar amount in the Present Value ($) field and a number for the Annual Return (%) field. For example, $100,000 at 5% equals $5,000.

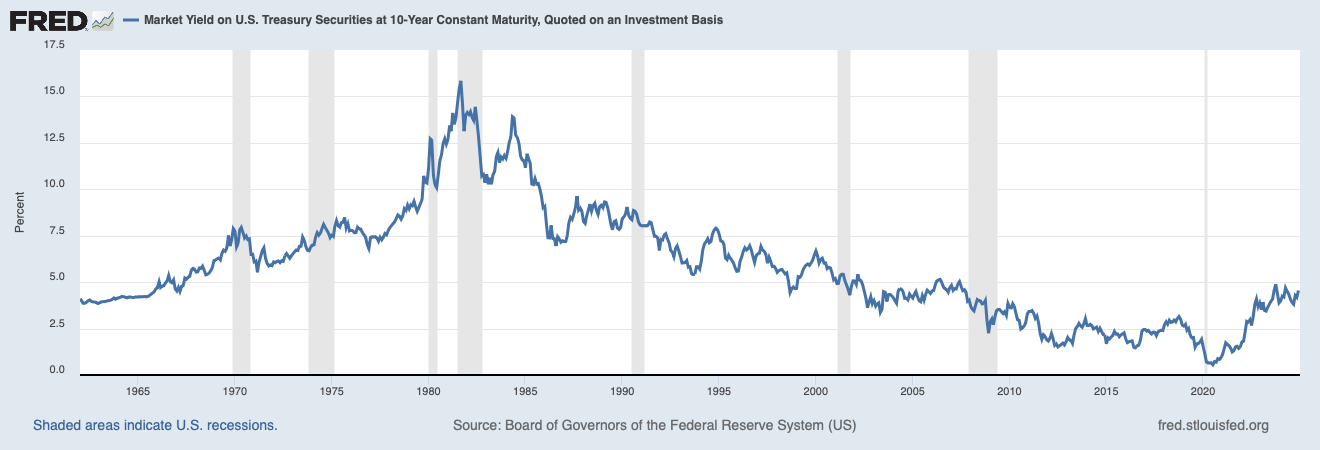

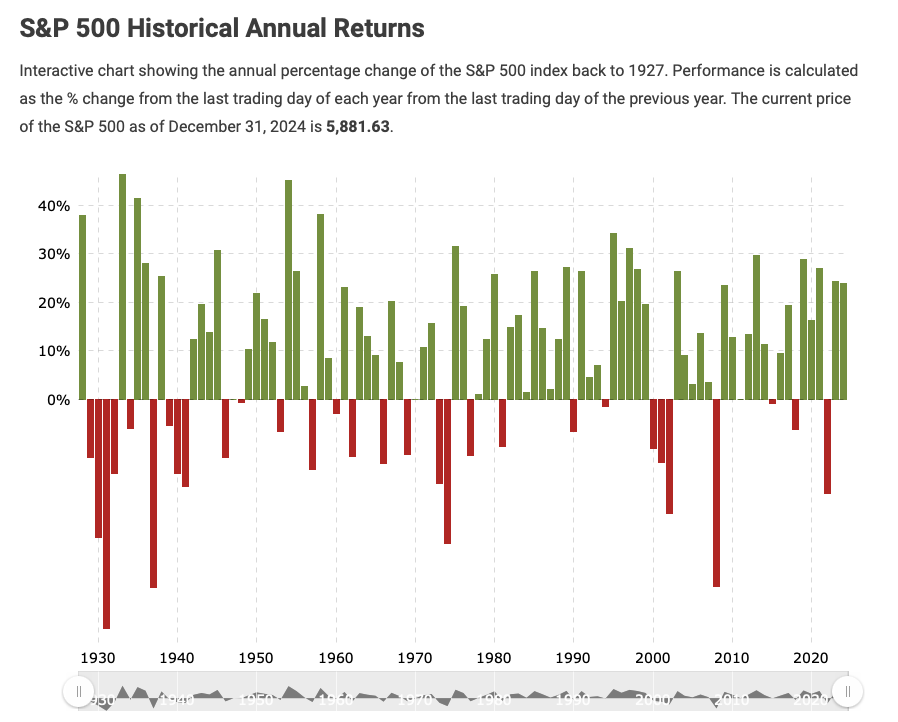

Now read the following when selecting an income percentage: The widely popular 4% rule suggests withdrawing 4% of your retirement account balance in the first year of retirement, followed by annual adjustments for inflation. It’s a straightforward guideline to provide a steady income stream while preserving enough capital for future years. However, my calculations show a more precise figure: 3.82% for a near 100% lifetime income success rate, assuming a 60% stock and 40% bond portfolio. The 4% rule is meant to help your retirement savings endure market fluctuations by capping withdrawals. Its goal is to balance enjoying your savings and sustaining them over time. Despite its popularity, the 4% rule has notable drawbacks: (1) It may not work for early retirees. (2) It fails to adapt to changing market conditions. (3) It assumes full Social Security benefits. (4) It presumes annual spending increases match inflation. Other Factors Include: (1) The investor’s risk tolerance, (2) tax rates, (3) time horizon, (4) and asset allocation. Note: While some experts propose a 5% rate for all but worst-case scenarios, others argue that 3% offers a safer margin.

Now go back to Number 5. For someone 75, the income stream after 10 years is 20.58%. In the Capital Requirement Calculator, enter $20,580 for Desired Income ($) and a realistic annual income percentage. Let’s go on the high side and use 5%. Press calculate, and in the screen above (Annual Income Calculator), it will say: “You need $411600.00 to generate an annual income of $20580 at an annual return of 5%.”

Now, in the Annual Return Calculator, enter 100000 for the Present Value (PV) and 411600 (do not use the $ sign and avoid using commas). Press Calculate.

Now return to the first Calculator (Annual Income Calculator), and you’ll see: “The annual return rate is 15.20%.”

How Lucky Do You Feel?

Let’s assume you are 75.

Let’s assume you have $100,000

Do you feel extremely lucky and will be able to average a 15.2% rate of return every year for the next ten years?

And then, do you think you can generate a 5% income stream, which is 20% above the recommended withdrawal amount, for the rest of your life?

And can you continue to do this when physically, emotionally, and/or cognitively impaired, or just plain elderly?

Annual Income Calculator

Capital Requirement Calculator

Annual Return Calculator

What Makes This Special?

Unlike Social Security and Defined Benefit Pension Plans, when you die, your heirs will inherit the remaining balance unless you have drawn out more than the balance.

Unlike a portfolio of stocks, bonds, funds, or real estate, for example, there is no income fluctuation.

Like Social Security, a Defined Benefit Pension Plan, and a traditional Immediate Annuity, you cannot outlive the income; however, unlike Social Security, a Defined Benefit Pension Plan, or a traditional Immediate Annuity, you CAN dip into the value of the account for health care or long-term care needs.