Long-Term Care

Here is the blunt reality for anyone age 50 and older: long-term care is the single greatest, most predictable threat to retirement security—and it is accelerating. Roughly 70% of Americans who reach age 65 will need some form of long-term services and supports before death. About half will need and pay for formal care at some point. Women need care longer than men. These are not edge cases. They are the norm. ([ACL Administration for Community Living][1])

Cognitive decline drives much of the cost. The best national data show that about one-third of adults 65 and older live with either dementia or mild cognitive impairment. That is not a small, unlucky cohort. It is one in three of your peers. Multiple meta-analyses place mild cognitive impairment alone in the mid-teens to mid-20% prevalence range, rising sharply with age. Translation: the odds of needing supervision, cueing, and hands-on help compound as you age. ([JAMA Network][2])

Dementia is the cost multiplier. The Alzheimer’s Association estimates 7.2 million Americans 65+ are living with Alzheimer’s today, with total health and long-term care spending for dementia projected at $384 billion in 2025—most of it borne by Medicare, Medicaid, and families out of pocket. Those totals are forecast to approach $1 trillion by mid-century. If your plan assumes “average” expenses, it is already obsolete. ([PMC][3])

Now add Florida-specific risk. Florida has among the highest dementia prevalence rates in the nation and the largest absolute number of residents living with Alzheimer’s. Approximately 580,000 Floridians 65+ are living with Alzheimer’s, supported by roughly 870,000 family caregivers providing 1.3 billion hours of unpaid care. That unpaid labor masks the true economic burden until a crisis forces placement or paid help. ([Alzheimer’s Association][4])

What does paid care actually cost in 2025? Nationally, the median annual cost for a semi-private nursing home room has jumped to roughly $111,000, and a private room to about $128,000. Florida tracks close to those figures, with recent surveys showing about $124,000 per year for a semi-private room and about $139,000 for a private room. At five years of care—entirely plausible for dementia—you are looking at $600,000 to $700,000 after taxes for one person. That is portfolio-ending for many households. ([carescout.com][5])

Memory care—assisted living settings specialized for cognitive impairment—also bites hard. The 2025 national median is about $7,785 per month, and Florida’s median is approximately $6,580 per month, with wide regional variation. In higher-cost markets and higher-acuity settings, families routinely see $8,000 to $11,000 per month before medications, therapies, or add-on staffing. If you have not modeled those numbers against your portfolio’s after-tax cash flow, you are gambling. ([SeniorLiving.org][6])

Here is why most families get crushed. First, Medicare does not pay for custodial long-term care. Second, only a small minority of older adults carry private long-term care insurance—about 15% of those 65+—and many policies are thin or lapsed. Third, Medicaid is means-tested. You either spend down, or you qualify through narrow pathways and waivers that are capacity-limited and vary by county and year. Waiting lists for home- and community-based services exist, and benefits are not guaranteed to match need. ([Center for Retirement Research][7])

Once dementia enters the picture, the math changes from “can we handle this at home” to “how long until someone gets hurt.” Nights, wandering, behavioral symptoms, and caregiver burnout make 24/7 coverage unavoidable. At $25 to $35 per hour for in-home aides, a true 24-hour schedule runs $18,000 to $25,000 per month. Very few portfolios can sustain that for long without forced liquidation at inopportune times, sequence-of-returns damage, and tax inefficiency. (Local agency quotes vary, but the nursing home and memory-care benchmarks above anchor the reality.) ([carescout.com][5])

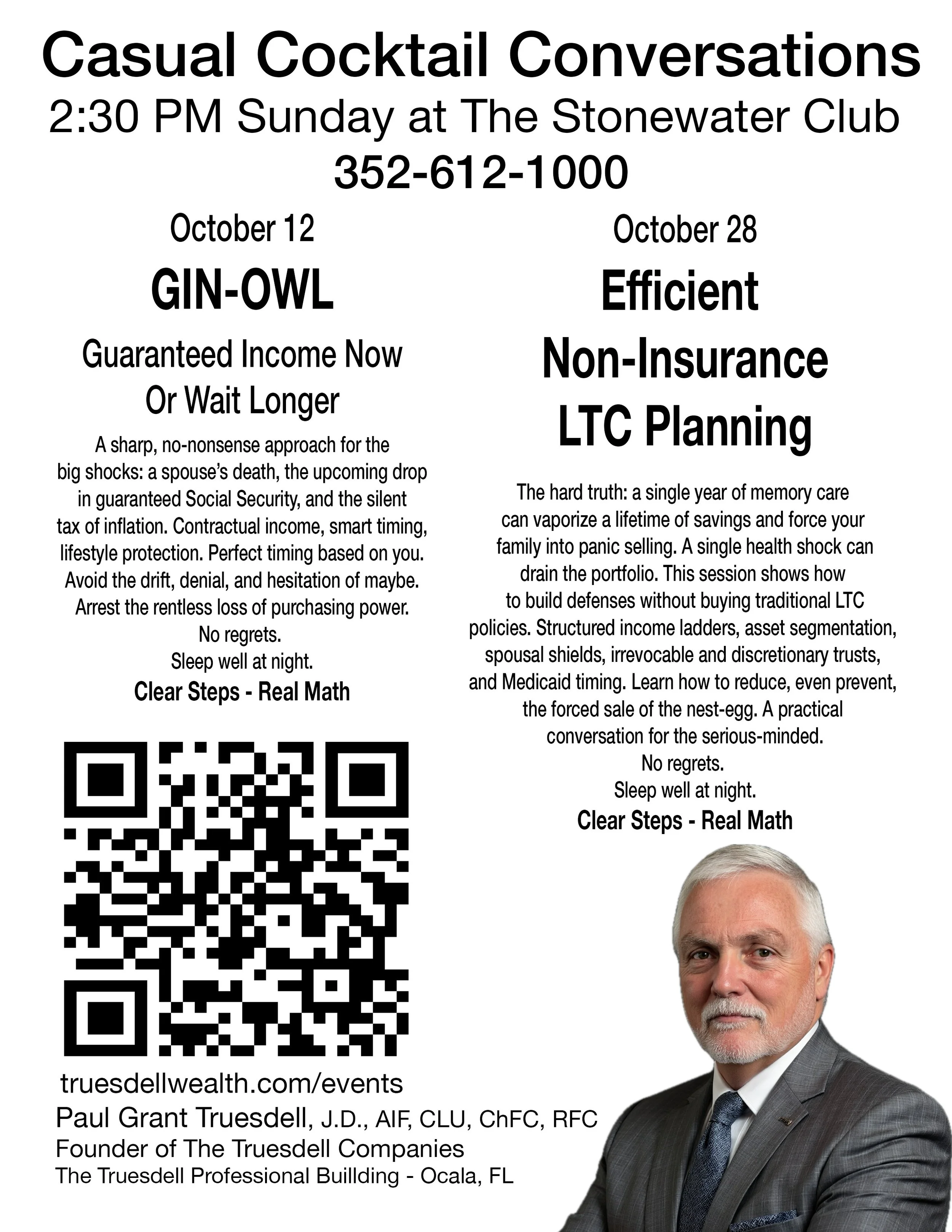

This is exactly why I have spent decades—since the mid-1980s—building asset-protection and care-planning structures for clients. The objective is simple: preserve dignity, maintain optionality, and protect the healthy spouse without sacrificing the entire estate to unplanned care costs. The tools are legal and financial, but the sequence matters: beneficiary design, titling, tax buckets, trust architectures, income ladders, and—where appropriate—contractual risk-transfer solutions that integrate with Florida’s Medicaid and creditor-protection frameworks. Delay converts optional planning into damage control.

If you are 50 to 70, here is the professional takeaway. Run a Florida-specific dementia scenario through your plan using today’s costs, not yesterday’s averages. Stress-test five to eight years of escalating memory-care or nursing-home expenses for one spouse, then both. Layer in caregiver replacement costs, transportation, uncovered therapies, and inflation. Assume that benefits and waivers are uncertain and that eligibility takes time. The question is not “Will this happen,” but “How will we pay when it does, without destroying the survivor’s lifestyle.” ([carescout.com][5])

If your plan does not decisively answer that question, you do not have a plan. You have a hope. Let us fix that—properly, lawfully, and with the experience of four decades spent protecting families from exactly this risk profile.

[1]: https://acl.gov/ltc/basic-needs/how-much-care-will-you-need?utm_source=chatgpt.com "How Much Care Will You Need?"

[2]: https://jamanetwork.com/journals/jamaneurology/fullarticle/2797274?utm_source=chatgpt.com "Estimating the Prevalence of Dementia and Mild Cognitive ..."

[3]: https://pmc.ncbi.nlm.nih.gov/articles/PMC12040760/?utm_source=chatgpt.com "2025 Alzheimer's disease facts and figures - PMC"

[4]: https://www.alz.org/professionals/public-health/state-overview/florida?utm_source=chatgpt.com "Public Health Action in Florida"

[5]: https://www.carescout.com/cost-of-care?utm_source=chatgpt.com "Cost of Long Term Care by State | Cost of Care Report"

[6]: https://www.seniorliving.org/memory-care/costs/?utm_source=chatgpt.com "Memory Care Costs | Average Costs of Dementia & ..."

[7]: https://crr.bc.edu/do-older-adults-understand-healthcare-risks/?utm_source=chatgpt.com "Most Adults Greatly Underestimate the Realities of Aging and ..."